The projected recession looms large and we wanted to provide some helpful info for context, and to help the small business owners we love prepare for what may be in-store.

We’re still reeling from the health and economic impacts of the COVID-19 pandemic. And, as we will see, the pandemic’s economic effects are not unrelated to the impending recession we’ve all been hearing (and worrying) about.

Thankfully, there are commonalities across previous recessions and learns we can take from them as small business owners.

Why are economists forecasting a recession?

The devastating impact of COVID-19 is abundantly clear in terms of health outcomes for individuals around the world.

That is, people were getting sick at a rapid pace, and mortality rates were extremely high in many countries. It was, and continues to be, a very challenging time for many people who have had direct and indirect health impacts from COVID-19. The overall health of individuals and communities is the number one priority for most governments and political parties moving forward while dealing with the lingering effects of the virus.

Projected recession, inflation, and COVID-19

Something that is talked about less than the health impacts of COVID-19 are the significant economic costs that many countries have been burdened with over the pandemic. This was especially difficult during the worst peak times of the virus.

Monetary policy decision-making was at the forefront of priorities from important and key country-wide organizations, such as Central Banks and government officials. The printing and increase of money supply by numerous developed, and some underdeveloped, countries’ governments has contributed directly to our current economic situation.

Here’s how.

The increase in money supply in the economy has driven up prices resulting in inflation. And we are now seeing challenging circumstances for many organizations— particularly for small businesses.

And government monetary policy changes are not the only contributing factor.

The major player in the global economy’s shift to less prosperity is changing consumer behaviour since the onset of the pandemic. Lockdowns, curfews, and business closures have all led to much uncertainty amongst consumers and a more conservative approach to spending.

in fact, less spending has been the main trend among consumers ever since the first news and realities of COVID-19 started to spread in early 2020.

Canada Inflation Forecast Total, Annual Growth Rate (%), From 2006 to Today

So, monetary policies and less consumer spending are two main contributors to why we’re seeing news headlines related to a potential recession on the way, for Canada and other countries around the globe.

Ok, but what exactly is a recession?

According to the National Bureau of Economic Research (NBER), a recession is, “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in GDP, real income, employment, industrial production and wholesale-retail sales”. Another more technical definition is that “two or more consecutive quarters of a negative growth rate of gross domestic product (GDP)”.

Canada Quarterly GDP Total, Percentage Change, From 2006 to Today

Both of these definitions have an underlying commonality—that recessions take time to get through. They are, in most cases, long-term events and patience is required.

The last time we as a society saw a recession of this magnitude forecasted was during the 2008 global financial crisis. This time the instigating financial crisis is the pandemic. Then, it was the 2008 housing market crash.

Economic situations for the vast majority of individuals in North America were very unstable during 2008-2009. All major trading markets, that being the TSX, NASDAQ, S&P 500, and more, saw sharp declines in value at a rapid pace.

Other indicators were pointing to a recession as well. Like the more recent predicted recession, there were a few contributing factors leading to the cause of the 2008 financial crisis.

Most notably, banks fell victim to junk bonds and a housing bubble which caught many off-guard. There were assets that banks, other financial institutions, and their clients, thought were viable.

But in actuality, they were largely worthless and this drove many individuals into debt levels that they were unable to re-pay.

What could the recession mean for small businesses?

Every recession that we have faced has its uniqueness and specific contributing factors associated with it. One common outcome, however, is that it impacts everyone. Businesses and consumers alike face economic hardship.

Below are some questions typically asked during a time of recession. We’ve provided some insights for context and to help navigate your way through as a small business owner.

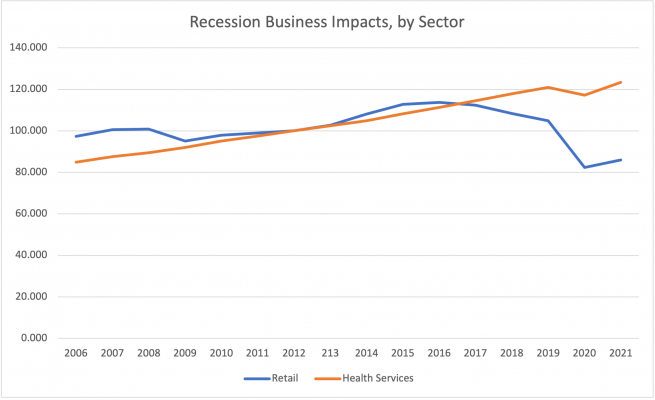

Question 1: Which business industries are hit the hardest during a recession?

Answer: Businesses which are impacted the most by a typical recession are those that are first affected by the increased savings from consumers’ shifts in behaviour or spending habits.

Examples of these industries are retail, restaurants, leisure, and hospitality. We know that a lot of small business owners work in this space. That’s why we’ve got some ideas for how to navigate this in Question 3 below. So keep reading!

Consumers will normally find substitutes for these sectors’ products or services through the means of spending less. One example might be that those who normally go out to restaurants a few times a week are now cooking more low-cost meals at home to increase their savings. By making this shift in behaviour, the change in consumer decision-making is thus having a direct, negative impact on the restaurant industry, as previously mentioned.

That being said, several business industries are not as affected by the recession challenges. Two of those sectors are healthcare services and accounting or bookkeeping, amongst others.

A similar rationale exists as to why these sectors are not as negatively impacted as others.

There are little to no substitutes for these sectors in society and amongst economies as we see today. An example of this can be seen from the illustration in ‘Figure 1’. This visualization shows that there is little to no change in total hours worked for the healthcare services sector. The same cannot be said for the retail sector as you can see more fluctuations in hours worked on a year-by-year basis.

Question 2: What impacts did the 2008 recession have on small businesses?

Answer: To quantify the true impacts of the 2008 recession on small businesses is a difficult task to achieve. However, what is known is that small businesses were impacted the most negatively by the recession in 2008. Remember the tips coming in Question 3!

There are a few reasons for this, and we’ll explore two here.

One is that local small businesses feel the greatest effects of consumer behaviour shifts as previously mentioned. Two is that during the 2008 recession, many large corporate firms were bailed out or supported financially by developed countries’ governments as a means to make sure that those companies did not completely lose their business as a whole.

This type of support was not as strong in terms of helping out small businesses that were also in a difficult economic situation.

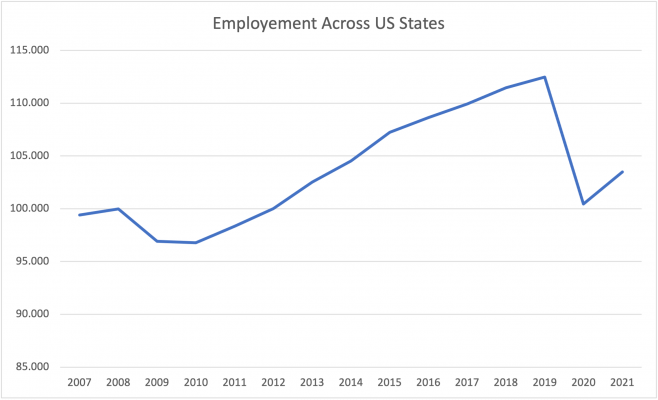

As shown in the table below, the period shortly after 2008 shows a dip in employment levels throughout the US. This reflects the situation during and slightly after the 2008 recession and the true impacts it had on North America as a whole.

Figure 2 also shows that there was economic growth and prosperity in the years following the 2008 recession. However, a big dip can be seen from the COVID-19 pandemic in the years 2019-2020.

This follows a similar pattern from the previous recession, but to a greater magnitude.

Question 3: How does the projected recession impact small business owners? What to do?

Answer: Just like all other groups, given certain contexts, there will need to be impactful decisions made by local small business owners or management.

These decisions will have implications for many people and their well-being. Workers will ultimately be impacted through a means of decreased income or financial hardship. According to a 2022 survey put on by the company ‘Veem’, a payment platform company, there are four main business operations which are most vulnerable when a recession is looming or is in effect: expansion, labour, office costs, and service delivery.

If you are a local small business owner, here are a few supported ideas which could help mitigate the impact of an upcoming recession:

- Scaling back expansion plans. Think staying on course, rather than ramping up production.

- Reducing your labour costs. If possible, retaining your key employees and working to streamline your processes can help. Remote work, flexible hours? Think creatively and ask your team for ideas

- Downsizing office or retail space.

- Cutting services. But still deliver what’s most valuable to your customers. Keep engaging and empathizing with them so that you can help in the most efficient way possible.

We’re not saying that the above are necessarily easy actions to take. But if you can manage to address a few of these areas, it can help your small business weather things a bit better.

Projected Recession and the importance of supporting small business owners.

It’s worth noting that one heartening difference in government support from the pandemic economic crisis as compared to the 2008 one, is that there was a strong focus on providing financial aid to small businesses—especially here in Canada. As mentioned previously, it was the banks and big businesses that were bailed out in the recession that followed the housing market crash of 2008. Not small businesses.

The pandemic government assistance was more focused on small businesses. It wasn’t perfect and still, small businesses were disproportionately affected, with many having to close up shop. However, many were helped through the pandemic financial crisis as a result of government financial support. It’s as though there was a recognition, finally, of what research has shown time and time again—that small businesses are the backbone of our economy. And supporting them benefits us all.

What’s next?

As we have seen the immediate impacts of COVID-19 from a health and healthcare standpoint, the ripple effect on the economic space is ramping up. There will be many hard business decisions for those in Canada and elsewhere globally, especially for small businesses.

Hopefully, this background information and tips for small business owners will give some support through the difficulties ahead.

One thing’s for sure: prioritizing buying from small business owners, as much as possible, will help us maintain our local supply chain, retain more purchase dollars locally, and of course, reduce our carbon footprint.

Helping us all navigate the projected recession in the best way possible. Together.